Mathematics is the only exact science. All power under heaven and on earth is given unto the man who masters the simple science of mathematics. Emerson said " God does indeed geometrize." Another wise man said " There is nothing in the universe but mathematical points " Pythagoras, one of the greatest mathematicians that ever lived, after experimenting with numbers and finding the proofs of all natural laws, said " Before God was numbers." He believed that the vibration of numbers created God and the Diety. It has been said, " Figures don't lie. " Men have been convinced that numbers tell the truth and that all problems can be solved by them. The chemist, engineer and astronomer would be lost without the science of mathematics. There are three kinds of angles -- the vertical, the horizontal, and the diagonal, which we use for measuring time and price movements. We use the square of odd and even numbers to get not only the proof of market movements, but the cause.

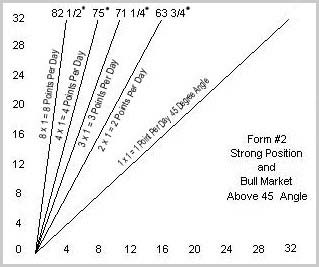

First Important Geometrical Angle : 45° or 1 x 1

The first and always most important angle to draw is a 45-degree angle or a moving-average that moves up one point per day, one point per week or one point per month. This is a 45° angle because it divides the Space and Time Periods into two equal parts. As long as the market or a stock stays above the 45° angle, it is in a strong position and indicates higher prices.

Forex, futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the Forex, futures and options markets. Don't trade with money you can't afford to lose. This website is neither a solicitation nor an offer to Buy/Sell Forex futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of experience and risk appetite. Do not invest money you cannot afford to lose.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

DISCLAIMER: The information on this site is for educational purposes only. Our website is not qualified or licensed to provide financial advice. You must seek guidance from your personal advisors before acting on this information. Trading can result in losses. We will accept no responsibility for any losses you may incur. Do not invest more than you can afford to lose. Please see other Disclaimers and Warnings elsewhere on this site.

By entering our website and/or purchasing our systems/tools/analysis, you agree to hold harmless the owners, principles, managers and all affiliates and associates of this website, for any and all losses you may incur by purchasing and using any of the Trading Systems.